Navigating Legal Budgeting in Uncertain Times: Four Insights for 2024

September 2023

By

Axiom Law

In case you missed it or want to revisit this important topic: Legal experts share actionable tips for in-house legal leaders as they navigate their 2024 budgeting strategy during uncertain times.

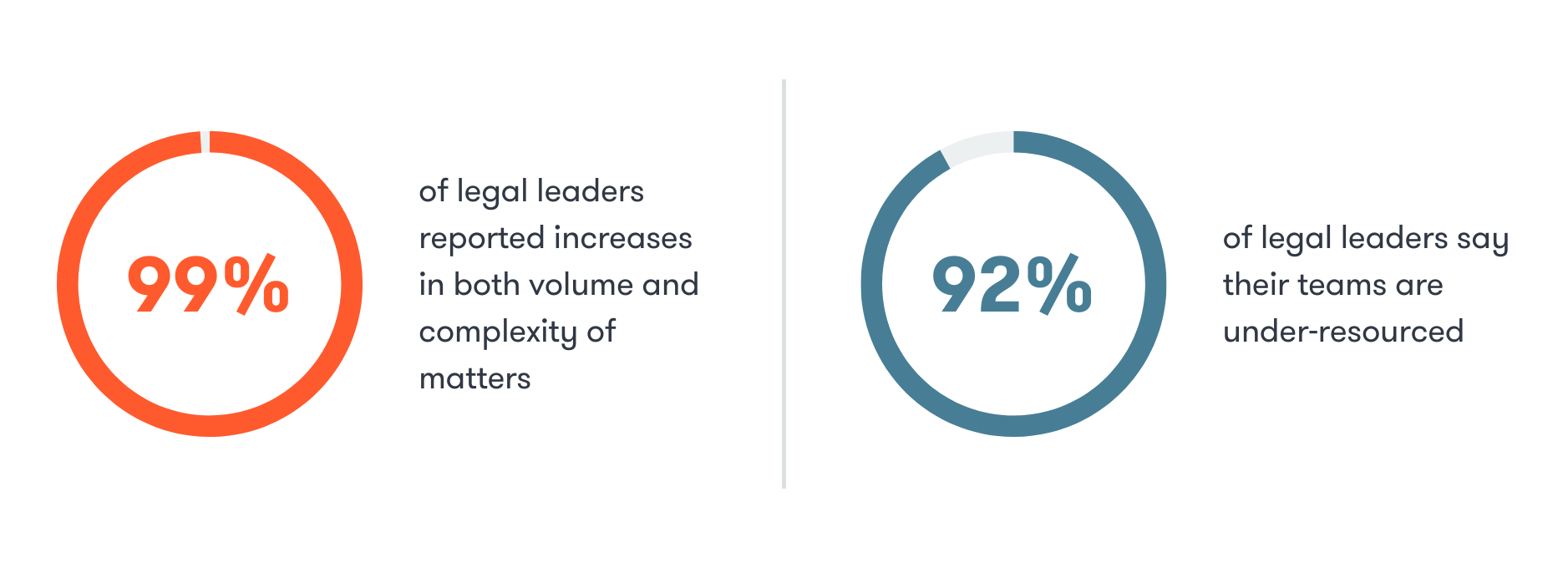

As 2024 budget planning gets underway, legal departments face a perfect storm of challenges. Workloads are surging — 99% of legal leaders in a recent Axiom survey reported increases in both volume and complexity of matters, yet 92% say their teams are under-resourced. And budgets were slashed across the board in 2023, compounding the resourcing gap.

Agility and adaptability have never been more critical for legal teams. In a recent webinar, Navigating Legal Budgeting in Uncertain Times: Insights for 2024, our panel of experts explored key trends shaping 2024 budgets, common budget pain points, and innovative strategies to empower legal leaders to navigate uncertainty ahead.

Moderated by Zach Abramowitz of Killer Whale Strategies, the discussion with Elizabeth Miller, former Head of Legal Operations at Marqeta, Dolby, and Boston Scientific, focused on practical budgeting solutions that can provide the flexibility legal teams need in turbulent times. The conversation revealed the following headline findings:

- Increasing Legal Fees Are Exacerbating Existing Budgeting Pains

- Budgets Must Evolve as Legal Talent Needs Change

- Weighing the Tradeoffs of Different Budgeting Approaches

- Modern Models: Agility-Based Budgeting

Headline 1: Increasing Legal Fees Are Exacerbating Existing Budgeting Pains

Despite widespread budget cuts, legal spending has continued to rise — nearly 34%, according to LegalDive. This presents major budgeting challenges:

- 99% of GCs report increasing workload complexity.

- But 92% say teams lack adequate resources to meet demands.

- 99% report talent gaps in key areas.

As Miller explained, lawyers face a tough learning curve shifting from law firms where spending is unrestrained to corporate legal teams with tighter budgets:

“I think it’s been a harder learning curve for lawyers who started out in a law firm, and they just charge whatever, and people throw money at them. That’s not how it works in the real world.”

The message is clear: GCs must take a disciplined approach to budgeting that maximizes value from every dollar spent. As Miller noted, legal can no longer operate in a silo — it must align spending to company priorities:

“You need to operate your department like it’s your own finances, and you can’t just be throwing money around. Every extra dollar you spend that you didn’t need to, that’s a cut in R&D or someone else’s headcount.”

Miller also noted the importance of scrutinizing budget line items and legal matter spend:

“The easiest way to look at the information is to bucket it by headcount cost, technology cost, consulting cost, and legal fees. And then break those out by ‘what type of legal fees are they?’ and ‘what are the matters?’ You need to understand what the matters are, how important they are, and how aligned outside counsel is on scope. Communicating more with firms is probably the best way to cut legal spend if you’re being hit with a cut.”

Fiscal responsibility is now imperative for GCs. With smarter budgeting, legal can stretch dollars further and balance rising workloads and talent gaps, even in an uncertain environment.

Headline 2: Budgets Must Evolve as Legal Talent Needs Change

As legal departments face increasing workloads and complexity, their talent needs are shifting — and budgets must align. Key trends impacting legal talent and budget planning include:

Labor and Employment Issues Are Front and Center

Labor and employment (L&E) matters have risen to the forefront of legal concerns, given lingering return-to-office and real estate questions. Many companies delayed definitive return-to-office plans during 2022-2023 based on COVID surges. Others allowed remote or hybrid policies to continue indefinitely.

However, recession concerns in 2024 may force companies to reduce real estate footprints and accelerate return-to-office plans. This will likely spark a surge of L&E issues around policy changes. Disability accommodations, vaccine mandates, hybrid work disputes, and more will require expertise.

Legal teams need adequate L&E lawyers and staffing to address the wave of concerns around shifting workplace models in a fragile economy. Budgets must evolve to prioritize these labor and employment professionals.

Cybersecurity and Privacy Needs Are Escalating

Privacy and cybersecurity legal specialists have risen in prominence as remote work creates new data protection risks. As Miller explained:

“If you are blessed to have an IT department that cares about Legal’s problems, they will be your best friend. In my last few jobs, IT team members were my best friends You likely need IT approval for new tools, even if Legal funds them.”

With hybrid and remote policies, companies have less visibility into how data is being handled. Lawyers accessing sensitive materials from home networks raise concerns. Meanwhile, cyber threats have dramatically increased.

Legal teams need adequate resourcing to address the new data privacy and security challenges of a distributed workforce. Cybersecurity expertise is critical to assess risks and implement appropriate controls. Budgets must evolve to prioritize these key roles.

New Issues Like AI Require Particular Skills and Experiences

In addition to remote work needs, cutting-edge issues like AI and automation are generating new specialty practice areas commanding budget attention.

While AI is ubiquitous, Miller believes it’s still early days for full automation in Legal:

“What I’ve seen on the AI side and legal tech — it’s just not all it’s hyped up to be yet. There’s more work to be done before AI can replace your second chair in the courtroom. Just unleashing general AI doesn’t yet give meaningful, efficient responses as the tools need more development.”

Rather than expecting AI to become a “generalist” solution, Miller recommends targeted AI tools thoughtfully implemented for specific use cases. Legal teams need legal talent experienced in AI to provide guidance on governance, ethics, risk, and more.

Budgets must fund emerging tech expertise, whether through outside specialists or developing in-house competencies. The key is understanding limitations — AI augments talent; it doesn’t replace the human element

Headline 3: Weighing the Tradeoffs of Different Budgeting Approaches

Legal teams often feel forced to choose between two traditional budgeting models, each with pros and cons. As Miller explained, a third option, consisting of a mixed, flexible approach, might be more optimal:

“Everybody should be looking at a mix of these two models. When you’re doing incremental budgeting, you should be thinking about these things anyway. You should be having conversations about the organizational structure, about how we actually use this tool. ‘Are we actually using this subscription?’ ‘Do we need to be using such an expensive law firm?’ You should be coming prepared to those budget discussions with 'Here’s where we’re spending the big bulks of money'.”

Here’s a breakdown of the two traditional models most legal teams currently employ, one way or another:

Precedent-Based Budgeting (PBB)

PBB simplifies the process by basing budgets on previous years rather than rebuilding from scratch.

Benefits:

- Simplifies a laborious process

- Avoids reinventing the wheel each year

Pitfalls:

- Assumes all current costs are still required without reexamination

- Entrenches inefficiencies

- Obstacle to addressing foundational budget issues

- Looks backward, not forward

Zero-Based Budgeting (ZBB)

ZBB starts budgets from zero each year, justifying every line item based on current needs.

Benefits:

- Scrutinizes all costs for true need

- Surfaces opportunities to improve efficiency

- Aligns budgets to evolving business landscape

Pitfalls:

- Extremely labor intensive

- Risk of overcorrecting and underbudgeting key area

Headline 4: There’s a Third, More Modern Option: Agility-Based Budgeting

Agility-based budgeting (ABB) has emerged as the modern, innovative approach that combines the best aspects of precedent-based and zero-based budgeting while avoiding some of their key pitfalls.

With precedent-based budgeting, teams essentially take last year’s budget and make incremental adjustments without fundamentally rethinking needs. While this simplifies the annual process, it can entrench inefficiencies and fail to align budgets with evolving priorities.

Unlike zero-based budgeting, ABB doesn’t require starting from scratch. The focus is shifting spend from fixed to variable costs. This flexibility removes obstacles to performance, agility, and efficiency.

According to Miller, leading legal teams have utilized principles of ABB for years to balance cost control with strategic priorities:

“You are getting Tier A talent at a Tier D price, and it’s flexible. So you’re not committing to bringing them in-house. It makes a lot more sense, and it’s flexible legal staffing, so we can use the resources when we want for as long as we want.”

In times of economic uncertainty, ABB also enables legal departments to dynamically align budgets to evolving business conditions. Building in variability and adjusting fixed costs creates wiggle room to address new challenges without sacrificing core functions.

The Seven Key Steps of ABB include:

- Use precedent-based budgeting for fixed legal costs like line items. Exclude headcount and providers.

- Conduct an FTE audit of in-house lawyer costs (i.e., salaries & benefits).

- Employ ABB for internal spend shift. Identify areas that can transition to flexible talent.

- Use ABB for firm spend shift. Pinpoint law firm work to transition to flexible talent.

- Create a quarterly forecasting process to spot deviations and adjust.

- Foster executive buy-in and develop key performance indicators.

- Engage the right external partner like Axiom for support.

The ABB approach bends to business needs instead of breaking under change. Building agility into budgets equips legal teams to adapt in times of uncertainty.

If you need support, consultation, or assistance building your ABB, Axiom can offer guidance around:

- Identifying positions and legal matters best primed for flexible talent success.

- Creating a budgetary framework, leveraging our:

- Real Cost Calculator to compare costs between flexible and in-house lawyers for specific open positions.

- Law Firm Savings Calculator to demonstrate how shifting work from law firms toward flexible talent can reduce outside counsel spend.

- Establishing benchmark KPIs beyond cost to measure results.

- Accessing the right flexible talent for your specific pilot needs.

💡 Uncover the essential strategies that can help you overcome challenges, optimize budget allocation, and enhance legal outcomes.

Access the Full Discussion Get Support from Axiom

Posted by

Axiom Law

Related Content

The State of the Legal Industry in 2023

Axiom's analysis on in-house legal department challenges in 2022, what potential pressures await legal leaders in 2023, and most importantly, how to prepare.

The Effect of Technology and Emerging Risks on 2025 Legal Department Budgets

Explore the recent 2025 Legal Budgeting survey results, what they mean for legal departments, and the potential risks of these trends in legal tech.

8 Reasons Why the Right Legal Budget Model Matters

Eight reasons why the right legal budget model matters for General Counsels in the 2022 budgeting process.

- Expertise

- North America

- Legal Department Management

- Must Read

- Perspectives

- Work and Career

- State of the Legal Industry

- Legal Technology

- Solutions

- Spotlight

- Artificial Intelligence

- Regulatory & Compliance

- United Kingdom

- Data Privacy & Cybersecurity

- Legal Operations

- General Counsel

- Australia

- Central Europe

- DGC Report

- Labor & Employment

- Banking

- Commercial & Contract Law

- Diversified Financial Services

- Hong Kong

- Investment Banking

- Large Projects

- News

- Singapore